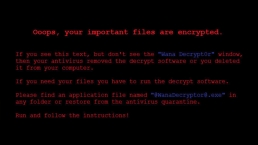

If the last couple years have taught us anything, it’s that consumers can only do so much to protect themselves from fraud. While some may be distrustful of shopping online, data breaches like those at Target have proven that traditional brick-and-mortar retailers are equally susceptible to being hacked.

Of course, it’s not just debit and credit cards in need of protection — passwords, Social Security numbers and nearly every other form of personal data is also ripe for the taking under the wrong circumstances, even for those of us normally diligent enough to escape the clutches of identity theft.

Let’s take a look back at the past 12 months and see if corporations have gotten any better at looking out for the best interest of consumers.

Anthem

In terms of size, Anthem Inc. tops our list for the last year after a “very sophisticated external cyber attack” nabbed the account information of “tens of millions” of customers at the nation’s second-largest health insurance provider in early February.

The breached database could ultimately wind up affecting as many as 80 million customers across 14 states, and is said to have included names, birthdates, Social Security numbers, employment data, email addresses and home addresses.

About the only thing the hackers didn’t get were credit card numbers and medical information on patients, but that’s probably little consolation under the circumstances.

Home Depot

As far as retailer data breaches go, Home Depot actually ranks higher than the 40 million cards nabbed at Target in late 2013, with 56 million credit and debit cards affected at more than 2,200 stores across the United States and Canada.

Announced by the home improvement chain last September, the intrusions began in April, using malicious software to nab card numbers as they were swiped at Home Depot’s point-of-sale terminals.

At this writing, Home Depot is actually the second-largest security breach — the TJX attack back in 2007 remains in the top spot with bad guys nabbing some 90 million accounts.

JP Morgan Chase

Retail attacks may be one thing, but a data breach at one of the nation’s largest banking institutions is a far scarier proposition. That’s exactly what took place last June and July at JP Morgan Chase, when hackers nabbed the personal information of 76 million customers.

The bank was quick to note there was no unusual fraud to be found in the wake of the breach, which also included nearly seven million small business customers and affected accountholders who access data on the web or from mobile devices.

While sensitive data like account numbers, passwords and Social Security numbers were never at risk, customer names, phone numbers as well as home and email addresses definitely were; Chase suffered a much smaller invasion in mid-2013 with prepaid debit card users.

New York State

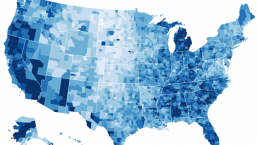

According to a report released last July by Attorney General Eric Schneiderman, no one in New York state is safe from data security breaches, with hackers cited in 40 percent of 5,000 incidents reported over the last eight years. (The remaining 60 percent involved lost or stolen equipment, errors or rogue employees.)

Although New York has about 19.5 million residents, the report noted that 22.8 million private records have been exposed in incidents reported by more than 3,000 businesses, nonprofit entities and government agencies.

Sony

Although it ultimately had little effect on consumers outside the studio, the Sony Pictures Entertainment hack made headlines long after being discovered on November 22, 2014, when hackers first threatened to publicly distribute a veritable treasure trove of Hollywood secrets.

It’s still unknown exactly how the attackers managed to get their virtual hands on nearly everything in SPE’s network before wiping it clean, but they wasted little time publicly embarrassing the entertainment giant with private correspondence between executives and details on movies still in production or yet to be released.

North Korea has been repeatedly fingered by the US government as the culprit behind the Sony attacks, widely blamed on the studio’s portrayal of the Communist nation’s Supreme Leader in the Seth Rogan-James Franco comedy The Interview.

Staples & Michaels

Malware was again to blame in a financial security breach affecting 1.16 million debit and credit cards used at office supply retailer Staples Inc. between April and September of last year.

Approximately 119 stores in 35 states were affected by the six-month breach, and the method of attack bore a striking resemblance to the one at arts and crafts retailer Michaels Stores Inc., which directly affected point-of-sale machines used by as many as three million customers.

Goodwill

Compromised point-of-sale machines were once again to blame for data breaches at Goodwill, which involved an estimated 868,000 credit and debit cards and went on undetected for a whopping 18 months.

The thieves grabbed data from 330 retail stores after breaking into third-party credit card processor C&K Systems, and Goodwill remained blissfully unaware of what was going on until outside investigators and Federal officials clued them in.

Dairy Queen

The so-called “Backoff” malware that made headlines at Target and Home Depot also wreaked havoc at 395 stores last summer owned by International Dairy Queen, affecting up to 600,000 debit and credit cards.

It could have been much worse: Dairy Queen has 4,500 franchise locations across the United States, but the intrusion coughed up the names, card numbers and expiration dates of affected customers in search of a tasty treat.

Morgan Stanley

2015 kicked off with investment firm Morgan Stanley revealing that a rogue employee managed to nab personal details for 350,000 customers (approximately 10 percent of the bank’s client base) prior to being terminated.

In one of the few cases involving actual theft of corporate data rather than an external intrusion, 900 of Morgan Stanley’s wealth management customers (i.e., rich folks) were actually at risk after their private information was sold on the black market.

P.F. Chang’s

Last but certainly not least, another restaurant chain suffering a high-profile security breach last summer was none other than upscale Asian cuisine outlet P.F. Chang’s China Bistro, which affected an undisclosed number of “certain” debit and credit cards over an eight-month period dating back to October, 2013.

That breach affected only 33 restaurants across 16 states, making it one of the smaller attacks over the last 12 months, but the hackers managed to swipe (pun intended) card numbers, but only some of the associated expiration dates and cardholder names.

![]()

Related Posts

December 6, 2021

7+ Web Design Trends for 2022: Which Will You Use?

December 6, 2021

The 10 Best WordPress Booking Plugins to Use On Your Website

December 6, 2021

How to Use a Web Cache Viewer to View a Cached Page

November 6, 2021

10 Modern Web Design Trends for 2022

November 6, 2021

Best Free SSL Certificate Providers (+ How to Get Started)

November 6, 2021

How to Design a Landing Page That Sends Conversions Skyrocketing

November 6, 2021

What Are the Best WordPress Security Plugins for your Website?

October 6, 2021

Your Guide to How to Buy a Domain Name

October 6, 2021

How to Build a WordPress Website: 9 Steps to Build Your Site

September 6, 2021

10 Best Websites for Downloading Free PSD Files

September 6, 2021

HTML5 Template: A Basic Code Template to Start Your Next Project

September 6, 2021

How Much Does It Cost to Build a Website for a Small Business?

September 6, 2021

A List of Free Public CDNs for Web Developers

September 6, 2021

6 Advanced JavaScript Concepts You Should Know

August 6, 2021

10 Simple Tips for Launching a Website

August 6, 2021

25 Beautiful Examples of “Coming Soon” Pages

August 6, 2021

10 Useful Responsive Design Testing Tools

August 6, 2021

Best-Converting Shopify Themes: 4 Best Shopify Themes

July 6, 2021

What Is Alt Text and Why Should You Use It?

July 6, 2021

24 Must-Know Graphic Design Terms

June 6, 2021

How to Design a Product Page: 6 Pro Design Tips

April 6, 2021

A Beginner’s Guide to Competitor Website Analysis

April 6, 2021

6 BigCommerce Design Tips For Big Ecommerce Results

April 6, 2021

Is WordPress Good for Ecommerce? [Pros and Cons]

March 6, 2021

Make Websites Mobile-Friendly: 5 Astounding Tips

March 6, 2021

Shopify vs. Magento: Which Platform Should I Use?

March 6, 2021

Top 5 Web Design Tools & Software Applications

February 6, 2021

Website Optimization Checklist: Your Go-To Guide to SEO

February 6, 2021

5 UX Design Trends to Dazzle Users in 2021

February 6, 2021

What Is the Average Page Load Time and How Can You Do Better?

February 6, 2021

Choosing an Ecommerce Platform That Will Wow Customers

February 6, 2021

7 Best Practices for Crafting Landing Pages with Forms

February 6, 2021

7 B2B Web Design Tips to Craft an Eye-Catching Website

January 6, 2021

Mobile-Friendly Checker | Check Your Site’s Mobile Score Now

January 6, 2021

8 Tips for Developing a Fantastic Mobile-Friendly Website

December 6, 2020

How to Add an Online Store to Your Website [4 Ways]

December 6, 2020

5 UX Design Tips for Seamless Online Shopping

November 6, 2020

Ecommerce Website Essentials: Does Your Site Have All 11?

November 6, 2020

5 Small Business Website Essentials You Need for Your Site

November 6, 2020

Your Website Redesign Checklist for 2020: 7 Steps for Success

May 1, 2020

Psychology of Color [Infographic]

April 21, 2020

How to start an online store that drives huge sales

January 3, 2020

5 Lead Generation Website Design Best Practices

March 6, 2019

6 Reasons You Should Redesign Your Website in 2019

March 6, 2019

7 Web Design Trends for 2019

February 19, 2019

Who owns the website/app source code, client or developer

February 7, 2019

Don’t Let Your Domain Names Expire in 2019

January 8, 2019

2019 Website Development Trends To Note

October 6, 2017

How Web Design Impacts Content Marketing

October 6, 2017

How to Choose a Navigation Setup

August 6, 2017

Why User Experience Matters to Marketing

July 6, 2017

5 Ways Web Design Impacts Customer Experience

September 6, 2016

How to Learn Angular

September 6, 2016

The Excuses for Not Having a Website (Infographic)

September 6, 2016

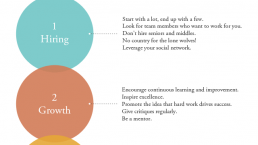

How to Build an Award-Winning Web Design Team

September 6, 2016

13 Free Data Visualization Tools

August 6, 2016

How Selling Pastries Helped Us Design a Better Product

August 6, 2016

11 Sites to Help You Find Material Design Inspiration

July 4, 2016

How to change free wordpress.com url

April 6, 2016

The 5 Best Free FTP Clients

April 6, 2016

7 Free UX E-Books Worth Reading

March 6, 2016

Can Handwritten Letters Get You More Clients?

December 10, 2015

Star Wars Week: How to create your own Star Wars effects for free

December 6, 2015

20 "Coming Soon" Pages for Inspiration

December 6, 2015

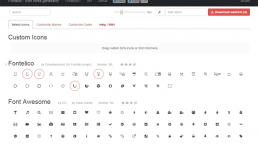

6 Free Tools for Creating Your Own Icon Font

December 6, 2015

9 Useful Tools for Creating Material Design Color Palettes

November 6, 2015

20 Free UI Kits to Download

November 6, 2015

50 Web Designs with Awesome Typography

November 6, 2015

When to Use rel="nofollow"

November 6, 2015

7 Free Books That Will Help You Become More Productive

November 6, 2015

50 Beautiful One-Page Websites for Inspiration

November 6, 2015

Circular Images with CSS

October 6, 2015

Lessons Learned from an Unsuccessful Kickstarter

October 6, 2015

5 Games That Teach You How to Code

October 6, 2015

Cheatsheet: Photoshop Keyboard Shortcuts

October 6, 2015

An Easy Way to Create a Freelance Contract for Your Projects

October 6, 2015

50 Design Agency Websites for Inspiration

September 29, 2015

JB Hi-Fi shutting the book on ebooks

September 24, 2015

Opinion: Quick, Quickflix: It's time to give yourself the flick

September 24, 2015

New Star Wars 360-degree video is among first on Facebook

September 21, 2015

Apple purges malicious iPhone and iPad apps from App Store

September 12, 2015

Apple's new Live Photos feature will eat up your storage

September 12, 2015

The latest Windows 10 Mobile preview has been delayed

September 12, 2015

IBM buys StrongLoop to add Node.js development to its cloud

September 8, 2015

Fake Android porn app takes your photo, then holds it ransom

September 6, 2015

50 Restaurant Websites for Inspiration

September 6, 2015

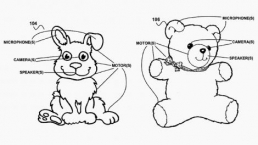

Zero UI — The Future of Interfaces

September 6, 2015

50 Beautiful Websites with Big Background Images

September 6, 2015

Infographic: 69 Web Design Tips

September 6, 2015

Free Windows 10 Icons

September 2, 2015

Instagram turns itself into a genuine messaging service

August 11, 2015

In Depth: How Microsoft taught Cortana to be more human

August 11, 2015

Windows 10 price, news and features

August 11, 2015

Windows 10's broken update introduces endless reboot loop

August 11, 2015

Windows 10 races to 27m installs

August 11, 2015

Windows 10 IoT Core gets first public release

August 10, 2015

iOS Tips: How to backup iPhone to an external drive

August 10, 2015

Windows 8.1 RT finally getting Windows 10 Start Menu

August 10, 2015

How to use Windows Hello

August 10, 2015

Review: Moto Surround

August 10, 2015

Review: Moto G (2015)

August 9, 2015

8 of the best free VPN services

August 8, 2015

Use Firefox? Mozilla urges you update ASAP

August 7, 2015

Mac Tips: Apple Mail: How to remove the Favorites Bar

August 7, 2015

How to make the OS X dock appear faster

August 7, 2015

Review: BQ Aquaris E45 Ubuntu Edition

August 7, 2015

Review: Acer Liquid Jade Z

August 6, 2015

How to reinstall Linux

August 6, 2015

How to reinstall Windows

August 6, 2015

Updated: Apple Music: release date, price and features

August 6, 2015

Social News Websites for Front-End Developers

August 6, 2015

10 Free JavaScript Books

August 6, 2015

50 Beautiful Blog Designs

August 6, 2015

Animated SVG Pipes Effect

August 6, 2015

Launching Your First App

August 5, 2015

Windows 10 goes freemium with paid apps

August 5, 2015

Updated: Week 1 with Windows 10

August 5, 2015

Mac Tips: How to manage Safari notifications on Mac

August 5, 2015

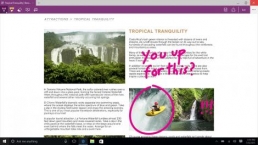

Microsoft Sway may kill the PowerPoint presentation

August 4, 2015

Microsoft gives Outlook on the web a new look

August 4, 2015

Mac OS X vulnerable to new zero-day attack

August 4, 2015

Windows 10 users warned of two scams

August 4, 2015

Microsoft's Docs.com is now available to everyone

August 3, 2015

Mac Tips: How to edit the Favorites sidebar on Mac

August 3, 2015

Updated: Windows 10 price, news and features

July 29, 2015

Review: HP ProDesk 405 G2

July 29, 2015

Hands-on review: HP Elite x2 1011

July 29, 2015

Hands-on review: Updated: Windows 10 Mobile

July 29, 2015

Review: Updated: Nvidia Shield Android TV

July 28, 2015

LIVE: Windows 10 launch: Live Blog!

July 28, 2015

How to prepare for your upgrade to Windows 10

July 28, 2015

Review: Updated: Windows 10

July 28, 2015

Review: Updated: HP Pro Tablet 608

July 28, 2015

Review: Heat Genius

July 28, 2015

Hands-on review: Moto X Play

July 28, 2015

Hands-on review: Moto X Style

July 28, 2015

Hands-on review: Moto G (2015)

July 28, 2015

Review: 13-inch MacBook Air (early 2015)

July 28, 2015

Hands-on review: OnePlus 2

July 28, 2015

Review: LG 65EG960T 4K OLED

July 28, 2015

Mac Tips: How to share printers on Mac

July 27, 2015

Apple Music's arrival hasn't opened Pandora's box

July 26, 2015

Review: Garmin Swim

July 25, 2015

How to merge OS X contacts into an existing list

July 25, 2015

Hands-on review: UPDATED: ZTE Axon

July 24, 2015

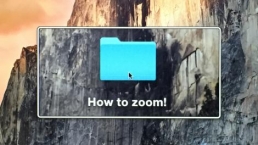

Mac Tips: How to zoom in on a Mac

July 24, 2015

What Windows 10 means for the enterprise

July 24, 2015

Review: JBL Charge 2 Plus

July 24, 2015

Review: Acer Aspire S7

July 24, 2015

Review: Updated: Canon G3 X

July 24, 2015

Review: Updated: iPad Air 2

July 24, 2015

Review: Thinksound On1

July 24, 2015

Review: Asus Chromebook Flip

July 24, 2015

Review: Garmin Forerunner 225

July 23, 2015

Review: Garmin nuvi 68LM

July 23, 2015

Review: Samsung Galaxy S6 Active

July 23, 2015

Review: Bowers and Wilkins P5 Wireless

July 23, 2015

Review: Dell XPS 15 (2015)

July 21, 2015

Review: Fuji S9900W

July 21, 2015

Review: Updated: Fitbit Surge

July 21, 2015

Review: UE Roll

July 21, 2015

Hands-on review: Ubik Uno

July 20, 2015

Review: Samsung HW-J650

July 20, 2015

Updated: 40 best Android Wear smartwatch apps 2015

July 20, 2015

Review: Acer Chromebook C740 review

July 20, 2015

Review: Huawei Talkband B2

July 20, 2015

Review: Dell Venue 10 7000

July 20, 2015

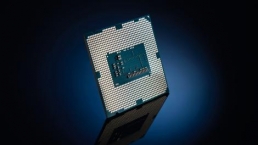

Review: Intel Core i7-5775C

July 17, 2015

Mac Tips: How to delete locked files on Mac

July 17, 2015

Review: Pebble Time

July 16, 2015

Microsoft just made Windows XP even less secure

July 16, 2015

Windows 8.1 RT is getting an update this September

July 16, 2015

OS showdown: Windows 10 vs Windows 8.1 vs Windows 7

July 16, 2015

Review: Acer CB280HK

July 15, 2015

Windows 10 is ready for new laptops and PCs

July 15, 2015

Explained: How to take a screenshot in Windows

July 15, 2015

Office for Windows 10 appears in latest build

July 14, 2015

Review: ZTE Axon

July 14, 2015

Review: ViewSonic VP2780-4K

July 14, 2015

Hands-on review: SanDisk Connect Wireless Stick

July 14, 2015

Review: Oppo PM-3

July 14, 2015

Review: BT 11ac Dual-Band Wi-Fi Extender 1200

July 14, 2015

Review: Fuji X-T10

July 13, 2015

How to build an SEO strategy for your business

July 13, 2015

Review: Lenovo ThinkPad Yoga 15

July 13, 2015

Review: Audio-Technica ATH-MSR7

July 13, 2015

Review: Garmin NuviCam LMT-D

July 13, 2015

Review: Dell Inspiron 13 7000

July 13, 2015

Hands-on review: AstroPi SenseHAT

July 13, 2015

Hands-on review: EE Rook

July 13, 2015

Hands-on review: Updated: HTC Vive

July 12, 2015

Here's the ultimate software list for PC fanatics

July 10, 2015

How to use the new Photos app for Mac

July 10, 2015

Windows 10 Insider Preview Build 10166 available now

July 10, 2015

Splunk spends big on cybersecurity acquisition

July 10, 2015

Making Windows 10 apps just got a whole lot easier

July 10, 2015

Review: Lenovo LaVie Z 360

July 9, 2015

OS X El Capitan public beta available right now

July 9, 2015

Microsoft finally unveils Office 2016 for Mac

July 9, 2015

Review: Updated: Chromecast

July 9, 2015

Review: Updated: Tesco Hudl 2

July 9, 2015

Review: Lenovo ThinkPad E550

July 9, 2015

Review: Updated: Google Nexus 6

July 8, 2015

What you need to know about Windows Server 2016

July 7, 2015

Microsoft to hike enterprise cloud pricing

July 6, 2015

Hacking Team end up being totally 0wned

July 6, 2015

Review: HP Pro Slate 12

July 6, 2015

Review: Samsung 850 Pro 2TB

July 6, 2015

Review: Asus RT-AC87U

July 6, 2015

Review: Jawbone UP2

July 6, 2015

Reimagining the Web Design Process

July 6, 2015

50 Clean Websites for Inspiration

July 6, 2015

15 Free Books for People Who Code

July 6, 2015

Web Storage: A Primer

July 6, 2015

A Look at Some CSS Methodologies

July 3, 2015

6 Essential Mac Mouse and Trackpad Tips

July 2, 2015

How to install a third party keyboard on Android

July 2, 2015

Review: UPDATED: Asus Zenfone 2

July 2, 2015

Review: Alienware 13

July 2, 2015

Review: HP DeskJet 1010

July 1, 2015

5 issues we want Apple Music to fix

June 13, 2015

Cortana will get its own button on Windows 10 PCs

June 12, 2015

Windows 10 will come with universal Skype app

June 12, 2015

iPad music production: 18 Best apps and gear

June 12, 2015

Windows 10 all set for early enterprise struggle

June 12, 2015

Review: Garmin VIRB Elite

June 11, 2015

Review: Updated: Nvidia Shield Tablet

June 11, 2015

Review: Nokia Lumia 635

June 10, 2015

Microsoft brings more online tweaks to Office 365

June 10, 2015

Mac Tips: How to use Screen Sharing in Mac OS X

June 9, 2015

Hands-on review: Meizu M2 Note

June 9, 2015

Hands-on review: EE 4GEE Action Camera

June 9, 2015

Review: Toshiba 3TB Canvio external hard drive

June 9, 2015

Review: Olympus SH-2

June 8, 2015

Hands-on review: Updated: Apple CarPlay

June 8, 2015

UPDATED: iOS 9 release date, features and news

June 8, 2015

Review: Updated: Roku 2

June 8, 2015

Review: Updated: PlayStation Vue

June 8, 2015

Review: Dell PowerEdge R730

June 8, 2015

Review: Canon SX710 HS

June 7, 2015

UPDATED: iOS 9 release date, features and rumors

June 7, 2015

Review: Lenovo S20-30

June 6, 2015

Free Writing Icons

June 6, 2015

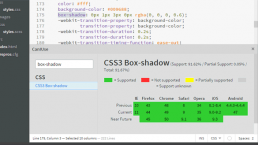

15 CSS Questions to Test Your Knowledge

June 6, 2015

The Best CSS Reset Stylesheets

June 6, 2015

How CSS Specificity Works

June 5, 2015

'Delay' is a new feature in Windows 10

June 5, 2015

Review: Beyerdynamic Custom One Pro Plus

June 5, 2015

Latest SEO Marketing tools

June 5, 2015

Review: Nvidia Shield Android TV

June 5, 2015

Review: Honor 4X

June 5, 2015

Review: In Depth: Oppo R5

June 3, 2015

Hands-on review: Huawei P8 Lite

June 3, 2015

How To: How to create eBooks on a Mac

June 3, 2015

Review: Updated: Tidal

June 3, 2015

Review: Canon 750D (Rebel T6i)

June 2, 2015

Review: Updated: Asus ZenWatch

June 2, 2015

Review: Alcatel OneTouch Idol 3

June 2, 2015

Review: Updated: Nokia Lumia 1520

June 2, 2015

Review: Updated: Yotaphone 2

June 2, 2015

Review: Updated: Nokia Lumia 625

June 2, 2015

Review: Creative Muvo Mini

June 1, 2015

Review: Acer TravelMate P645 (2015)

June 1, 2015

Hands-on review: Corsair Bulldog

May 29, 2015

In Depth: NetApp: a requiem

May 29, 2015

July is looking definite for Windows 10 release

May 29, 2015

Hands-on review: Google Photos

May 28, 2015

Mac Tips: The 16 best free GarageBand plugins

May 28, 2015

Review: Canon 760D (Rebel T6s)

May 27, 2015

Review: Lenovo Yoga 3 14

May 27, 2015

Hands-on review: Serif Affinity Photo

May 27, 2015

Review: Garmin Vivoactive

May 26, 2015

Review: Datacolor Spyder5 Elite

May 26, 2015

Hands-on review: Sony Xperia Z3+

May 26, 2015

Review: Epson BrightLink Pro 1410Wi

May 26, 2015

Review: Technics Premium C700

May 26, 2015

Review: Canon EOS M3

May 26, 2015

Review: Updated: HTC One M9

May 26, 2015

Review: Updated: Sony Xperia Z3 Compact

May 25, 2015

Review: Updated: New Nintendo 3DS

May 25, 2015

Updated: 50 best Mac tips, tricks and timesavers

May 25, 2015

Updated: Windows email: 5 best free clients

May 25, 2015

Instagram is planning to invade your inbox

May 25, 2015

Review: Updated: Foxtel Play

May 24, 2015

How Windows 10 will change smartphones forever

May 24, 2015

Review: Vodafone Smart Prime 6

May 24, 2015

Review: Updated: iPad mini

May 22, 2015

Office Now may be Cortana for your work life

May 22, 2015

Review: Updated: Lenovo Yoga 3 Pro

May 22, 2015

Review: Microsoft Lumia 640 LTE

May 22, 2015

Review: Updated: Fitbit Flex

May 21, 2015

Updated: Best free Android apps 2015

May 21, 2015

Review: Asus ZenBook Pro UX501

May 21, 2015

Review: Sennheiser Momentum In-Ear

May 20, 2015

Hands-on review: UPDATED: Asus Zenfone 2

May 20, 2015

OS X 10.11 release date, features and rumors

May 18, 2015

Updated: Best free antivirus software 2015

May 18, 2015

iPhone 6S rumored to launch as soon as August

May 18, 2015

Microsoft ready to pounce and acquire IFS?

May 17, 2015

5 of the most popular Linux gaming distros

May 16, 2015

Review: Acer Chromebook 15 C910

May 16, 2015

Review: Lenovo ThinkPad X1 Carbon (2015)

May 16, 2015

Review: Polk Nue Voe

May 16, 2015

Hands-on review: Updated: LG G4

May 16, 2015

Review: Updated: Quickflix

May 16, 2015

Review: LG Watch Urbane

May 16, 2015

Review: Razer Nabu X

May 16, 2015

Hands-on review: Updated: Windows 10

May 16, 2015

Review: UPDATED: Moto X

May 16, 2015

Review: Updated: Moto G (2013)

May 12, 2015

Review: TomTom Go 50

May 12, 2015

Review: Updated: Moto G (2014)

May 12, 2015

Review: Garmin Vivofit 2

May 12, 2015

Review: Asus Transformer Book Flip TP300LA

May 11, 2015

Review: MSI GT80 Titan

May 11, 2015

Review: Monster SuperStar BackFloat

May 9, 2015

Review: Updated: Apple Watch

May 7, 2015

5 million internet users infected by adware

May 7, 2015

Review: Updated: New MacBook 2015

May 6, 2015

Android M will be shown at Google IO 2015

May 6, 2015

Review: Epson WorkForce Pro WF-4630

May 6, 2015

Review: Master & Dynamic MH40

May 6, 2015

How to Use Gulp

May 6, 2015

Getting Started with Command-Line Interfaces

May 6, 2015

What It’s Like to Contribute to WordPress

May 6, 2015

Ultimate Guide to Link Types for Hyperlinks

May 6, 2015

11 Things You Might Not Know About jQuery

May 5, 2015

Hands-on review: Updated: PlayStation Now

May 5, 2015

Review: Lenovo ThinkPad Yoga 12

May 5, 2015

Review: Updated: iPad Air

May 5, 2015

Review: Panasonic SZ10

May 5, 2015

Review: Updated: Fetch TV

May 4, 2015

Review: Cambridge Audio Go V2

May 3, 2015

Review: Lightroom CC/Lightroom 6

May 2, 2015

5 of the most popular Raspberry Pi distros

May 1, 2015

Review: PlayStation Vue

May 1, 2015

Hands-on review: Updated: Microsoft HoloLens

April 30, 2015

Build 2015: Why Windows 10 may not arrive until fall

April 29, 2015

The biggest announcements from Microsoft Build 2015

April 29, 2015

Hands-on review: TomTom Bandit

April 29, 2015

Hands-on review: EE Harrier Mini

April 28, 2015

Review: Samsung NX500

April 28, 2015

Hands-on review: LG G4

April 28, 2015

Review: Patriot Ignite 480GB SSD

April 28, 2015

Hands-on review: EE Harrier

April 28, 2015

Review: Linx 10

April 28, 2015

Review: 1&1 Cloud Server

April 26, 2015

Hands-on review: Acer Iconia One 8

April 25, 2015

How to run Windows on a Mac with Boot Camp

April 24, 2015

Dropbox Notes poised to challenge Google Docs at launch

April 24, 2015

Hands-on review: Acer Aspire E14

April 24, 2015

Hands-on review: UPDATED: Valve Steam Controller

April 24, 2015

Review: Acer Iconia One 7

April 23, 2015

Windows 10 just revived everyone's favorite PC game

April 23, 2015

Google opens up Chromebooks to competitors

April 23, 2015

Here's how Outlook 2016 looks on Windows 10

April 23, 2015

Hands-on review: Updated: Acer Liquid M220

April 23, 2015

Hands-on review: Acer Aspire Switch 10 (2015)

April 23, 2015

Hands-on review: Acer Aspire R 11

April 22, 2015

Review: Alienware 17 (2015)

April 22, 2015

Hands-on review: Updated: HP Pavilion 15 (2015)

April 21, 2015

This is how Windows 10 will arrive on your PC

April 21, 2015

Review: iMac with Retina 5K display

April 21, 2015

Review: Epson XP-420 All-in-One

April 18, 2015

Google Now brings better search to Chrome OS

April 17, 2015

Review: Epson Moverio BT-200

April 17, 2015

Review: Pentax K-S2

April 16, 2015

Updated: Android Lollipop 5.0 update: when can I get it?

April 15, 2015

Hands-on review: Updated: Huawei P8

April 15, 2015

Review: SanDisk Ultra Dual USB Drive 3.0

April 15, 2015

Review: Updated: LG G3

April 15, 2015

Review: Updated: LG G3

April 15, 2015

Review: Crucial BX100 1TB

April 13, 2015

iOS 8.4 beta reveals complete Music app overhaul

April 13, 2015

Linux 4.0: little fanfare for a tiny new release

April 13, 2015

Achievement unlocked: Microsoft gamifies Windows 10

April 13, 2015

Best Android Wear smartwatch apps 2015

April 13, 2015

Review: Acer Aspire R13

April 12, 2015

Review: TP-Link Archer D9

April 10, 2015

Microsoft's new browser arrives for Windows 10 phones

April 10, 2015

Review: LG UltraWide 34UC97

April 9, 2015

Office now integrates with Dropbox on the web

April 9, 2015

Now you can buy video games with Apple Pay

April 9, 2015

Updated: iOS 8 features and updates

April 9, 2015

Microsoft's stripped down Nano Server is on the way

April 8, 2015

Skype Translator gets even more features

April 8, 2015

Windows mail services hit by widespread outages

April 8, 2015

Review: UPDATED: Amazon Echo

April 8, 2015

Hands-on review: Dell Venue 10 7000

April 8, 2015

Review: Updated: OS X 10.10 Yosemite

April 7, 2015

Google's GMeet could kill teleconferencing

April 7, 2015

Is Redstone the first Windows 10 update?

April 7, 2015

Next peek at Windows Server 2016 due next month

April 7, 2015

Review: Acer Aspire Switch 11

April 7, 2015

Review: Adobe Document Cloud

April 6, 2015

Hands-on review: Updated: New MacBook 2015

April 6, 2015

Freebie: 100 Awesome App Icons

April 6, 2015

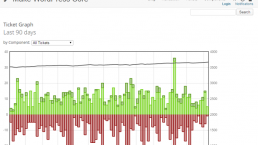

Six Revisions Quarterly Report #1

April 6, 2015

A Modern Approach to Improving Website Speed

April 6, 2015

Disable Text Selection with CSS

April 4, 2015

Review: Nikon D7200

April 3, 2015

Amazon Prime video now streams to any Android tablet

April 3, 2015

Review: Google Cardboard

April 3, 2015

Review: MSI WS60

April 2, 2015

Chrome users can now run 1.3 million Android apps

April 2, 2015

See Windows 10 Mobile running on an Android handset

April 2, 2015

Review: Mini review: Macphun Noiseless Pro 1.0

April 2, 2015

Review: Intel SSD 750 Series 1.2TB

April 2, 2015

Review: BenQ TreVolo

April 2, 2015

Hands-on review: Nikon 1 J5

April 1, 2015

Microsoft launches Windows 10 music and video apps

April 1, 2015

Review: mini review: Sony XBA-H1

December 19, 2014

Review: CoPilot Premium sat nav app

December 19, 2014